System Dynamics Calculator

Appendix: The Modeling Process

The Personal Finance Model

The modeling process begins with the identification of objectives and relationships that are relevant to the user. In the following example of a household finance and budget problem, the concept of a stock and a flow are explored. The user has an accurate “Income Statement” of sources and uses of their cash from their personal finance software such as Quicken. In their planning, the user has a budget, a contingent plan to survive a financial crisis or a “shortfall”, a wish list of uses for a windfall or a “surplus” and an objective to eliminate their credit card debt. While their plans are fairly well understood, the plans are relatively “static”, and the planning horizon is generally short term.

Entities Kept and Measured

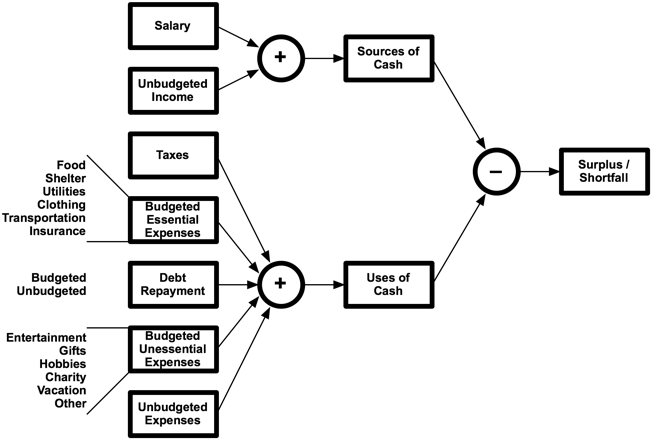

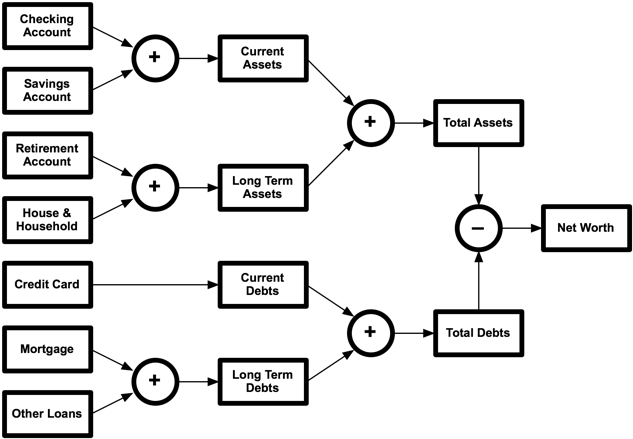

The following are two simple drawing of household expenses that the user has identified in their finances. The user demonstrated a poor understanding of finance by initially failing to distinguish between the transient nature of food expenses for example and the persistent nature of their mortgage loan. This naivety demonstrates a real need for templates and ready-built models.

Typical Household Finances Mapped to an Income Statement

Typical Household Finances Mapped to a Balance Sheet

Flows Between the Entities

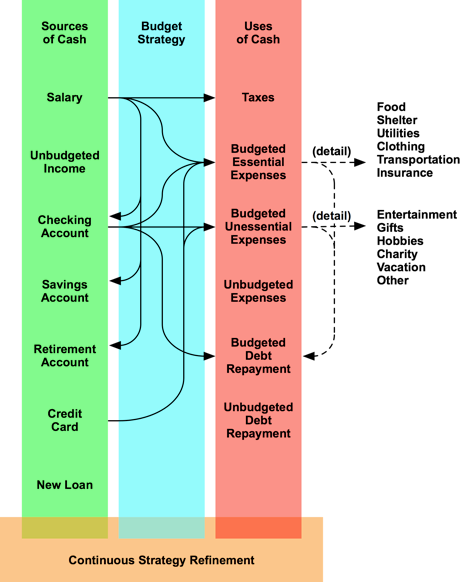

The user describes their finances further by considering their budgeting process in some detail. The three drawings that follow illustrate the different flows that the family experiences as their finances experience perturbations from shortfalls and windfalls. The following drawing illustrates the normal budget allocation process and the flows that result:

Typical Household Current Period Flows

The budgeting process is an allocation problem to suit a number of financial and lifestyle objectives:

•meet all essential living expenses and obligations through a sensible combination of cash and credit

•meet a reasonable level of unessential living expenses through a sensible combination of cash and credit

•save for a lapse of income, a vacation or a “rainy day”

•save for a comfortable retirement

The budgeting strategy is refined continuously to address changes in financial and lifestyle objectives, surpluses and shortfalls. The following drawing illustrates changes in budgeted flows necessary to manage a shortfall:

Potential Flows to Respond to Shortfalls

Shortfalls are the result of several scenarios:

•marginally over budget for current expenses

•unbudgeted current expenses such as automobile repairs or additional tax payments

•unanticipated permanent changes in budgeted expenses such as a “stair step” increase in insurance premiums or in mortgage interest rate

•unbudgeted long term expenses such as a new car or house

•loss of income

Shortfall management is a process of providing cash to meet the shortfall from available sources such as the savings account and by increasing the use of credit in a manner that minimizes the impact to a person’s longer term financial and lifestyle objectives. Insufficient levels of cash in the checking account or excess levels of credit card balances “trigger” the shortfall management process. If the shortfall management process is initiated for a number of consecutive periods of time, a rebudgeting process is triggered. Since the impact of a shortfall is immediate and detrimental, the rebudgeting process is usually triggered quickly after a small number of periods.

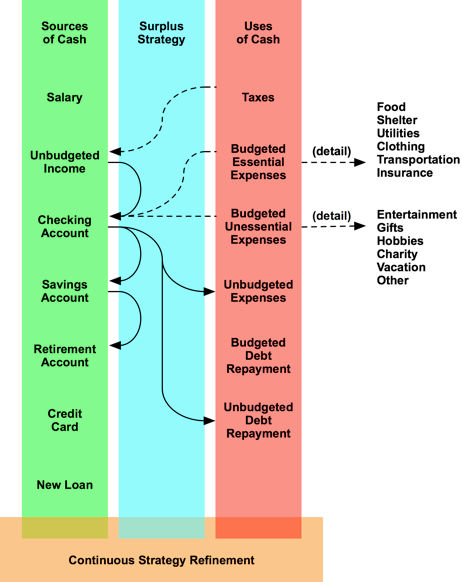

The following drawing illustrates changes in budgeted flows necessary to manage a windfall or surplus:

Potential Surplus Sources and Reallocation Flows

Surpluses are the result of several scenarios:

•marginally under budget for current expenses due to less consumption or improved “budget-mindedness”

•an unanticipated receipt of cash from a rebate or a tax refund

•a long term increase in credit available

•a long term increase in income such as a raise in salary

Surplus management is a process of allocating the surplus between savings vehicles and consumption in a manner that improves a person’s financial and lifestyle objectives. Excess levels of cash in the checking account or savings account “trigger” the surplus management process. If the surplus management process is initiated for a number of consecutive periods of time, a rebudgeting process is triggered. Since the impact of a surplus is not significant in the near term, there is no urgency to initiate a rebudgeting process.

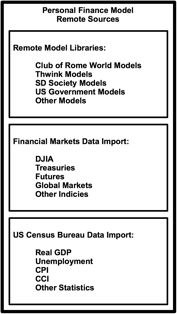

Internal and External Data Sources

To apply the System Dynamics Calculator, sources of essential data are identified. The following are sources of data:

Appendix: The Modeling Process

The Personal Finance Model

Entities Kept and Measured

Flows Between the Entities

Internal and External Data Sources